With the various financial circumstances that students are under, saving money can be hard. They pay thousands in tuition, car payments, insurance, and other necessities, which leaves little space to properly manage their money in savings. For example, social events, such as concerts are my go-to when it comes to entertainment, which can be pricey. Picking my wants over my needs creates an imbalance in my budgeting and does not allow for money to be saved. Managing money can be beneficial not only in the present but also in future endeavors that will allow you to continue your education, a trip, or emergencies.

Students need to come to terms with what they want for their future, and setting a goal can allow them to have that motivation and discipline to save money. Budgeting habits are necessary when setting aside any money after paying bills for the month. Precisely analyzing spending habits and learning to manage allows students to have a set savings system. For many, it could be hard to start up a consistent system, but once they set their goals and become determined, they can achieve anything.

Setting Goals

Photo Credit: Estee Janssens, Unsplash

Getting to know what their goals are is the first step to coming to terms with what students want to achieve. These goals allow people to further prepare themselves for the different parts of their future, whether that be for a new car, education, or other expenses. Not only do students need to be persistent, but they must also learn to have self-control over what they spend, which comes in handy when budgeting for savings.

Budgeting

One method to approach budgeting is having a ratio of expenses that correlates with one’s income. Budgeting makes it easier to plan, save, and control your expenses. Depending on one’s income, money ratios can be modified to fit their specific circumstance and goals. The most commonly used ratio is the 50-30-20, which splits your paycheck by 50% for needs, 30% on wants, and 20% on savings. This ensures that there is no overspending and creates a separation between the “needs” and “wants” that can help make a budget.

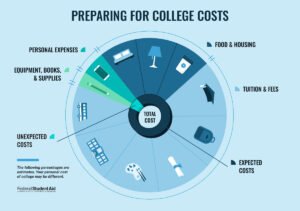

Courtesy of The Federal Student Aid Department (FAFSA)

The Federal Student Aid states that budgeting will help you avoid debt and control your expenses while in school. As one sticks to a certain method, they can maintain and improve it as they continue to save. Close attention is necessary to see income and spending amounts which will allow you to calculate the different finances

Student Testimony and Advice

Guadalupe Garnica, a student of Vanguard University, said, ” I think that if you can’t control your spending, it is a matter of priority and how you value your money” which indicates that there is a certain way that money is perceived. Some believe that it is an asset that can easily be returned, but if there is no consideration of how much you are spending, it will get harder to maintain a balance. Prioritizing correctly can help alleviate any financial burdens and allow a gap for saving, but if it is not managed it could eventually fall apart.

Learning to create a habit of separating the ‘needs’ and ‘wants’ can create a better spending pattern and allow people to set money aside for future goals. Guadalupe Garnica had a difficult time at first with budgeting, but after learning her habits and setting a goal, she was able to be more consistent and disciplined herself to save money. She recommends that people make sure they have money for essentials, and at the same time have enough money to take care of themselves. This expresses that regardless of what budgeting method one chooses, one should not limit oneself from having some self-care and fun.

The Liturgical Calendar: Should Christians Observe It?

The Liturgical Calendar: Should Christians Observe It? Sweet Sensations with Baking

Sweet Sensations with Baking Embracing Authenticity in the Pursuit of Success: A Reflection on Journalism, Education, and Meaningful Academia

Embracing Authenticity in the Pursuit of Success: A Reflection on Journalism, Education, and Meaningful Academia Spring Concert: Music From Around the World

Spring Concert: Music From Around the World

Leave a Reply